- #PINE GROVE FINANCIAL CALCULATORS HOW TO#

- #PINE GROVE FINANCIAL CALCULATORS FULL#

- #PINE GROVE FINANCIAL CALCULATORS PLUS#

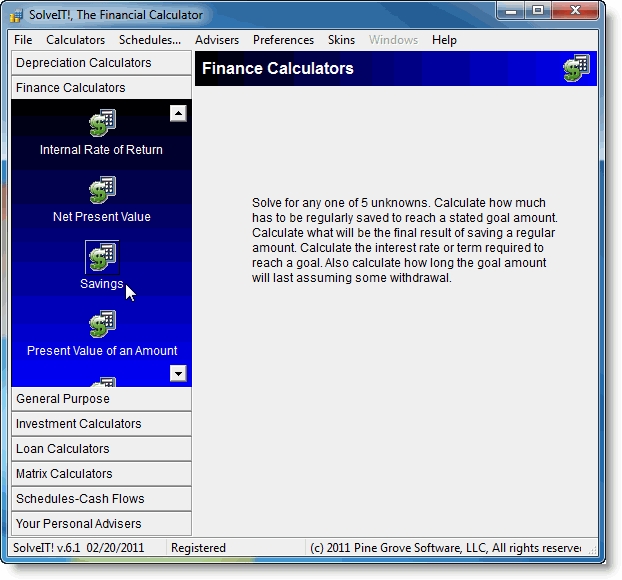

Our web-based financial calculator can serve as a good tool to have during lectures or homework, and because it is web-based, it is never out of reach, as long as a smartphone is nearby.

#PINE GROVE FINANCIAL CALCULATORS HOW TO#

It's not the ability to perform calculations by hand that's important it's the understanding of financial concepts and how to apply them using these handy calculating tools that were invented. While most basic financial calculations can technically be done by hand, professors generally allow students to use financial calculators, even during exams. Finance Classįor any business student, it is an immensely difficult task to navigate finance courses without a handy financial calculator. Don't forget to choose the correct input for whether payments are made at the beginning or end of compounding periods the choice has large ramifications on the final amount of interest incurred. As another example, what about the evaluation of a business that generates $100 in income every year? What about the payment of a down payment of $30,000 and a monthly mortgage of $1,000? For these questions, the payment formula is quite complex, so it is best left in the hands of our Finance Calculator, which can help evaluate all these situations with the inclusion of the PMT function. Otherwise, they have no conclusive evidence that suggests they should invest so much money into a rental property. Investors may wonder what the cash flow of $1,000 per month for 10 years is worth. Take, for instance, a rental property that brings in rental income of $1,000 per month, a recurring cash flow. PMT or periodic payment is an inflow or outflow amount that occurs at each period of a financial stream. The fourth part is $1, which is interest earned in the second year on the interest paid in the first year: ($10 × 0.10 = $1).The third part is the other $10 interest earned in the second year.The second part is the $10 in interest earned in the first year.The first part is the first $100 original principal, or its Present Value (PV).This $121 FV has several different parts in terms of its money structure: In the example, the PV of an FV of $121 with a 10% discount rate after 2 compounding periods (N) is $100. $121 is the future value of $100 in two years at 10%.Īlso, the PV in finance is what the FV will be worth given a discount rate, which carries the same meaning as interest rate except applied inversely with respect to time (backward rather than forward. $11 will be earned in interest after the second year, making a total of: However, if that money is kept in the savings account further, what will be the resulting FV after two years, assuming the interest rate remains the same? The original $100 investment is now $110. Because $100 was invested in this case, the result, or FV, is: In our example, r is 10%, so the investment grows to: In general, investing for one period at an interest rate r will grow to (1 + r) per dollar invested.

$110 is the future value of $100 invested for one year at 10%, meaning that $100 today is worth $110 in one year, given that the interest rate is 10%.

#PINE GROVE FINANCIAL CALCULATORS PLUS#

This $110 is equal to the original principal of $100 plus $10 in interest. How much will there be in one year? The answer is $110 (FV). Suppose $100 (PV) is invested in a savings account that pays 10% interest (I/Y) per year. This increased value in money at the end of a period of collecting interest is called future value in finance.

This is also why the bank will pay more for keeping the money in long and for committing it there for fixed periods. This is the basis of the concept of interest payments a good example is when money is deposited in a savings account, small dividends are received for leaving the money with the bank the financial institution pays a small price for having that money at hand. The "time value of money" refers to the fact that a dollar in hand today is worth more than a dollar promised at some future time.

#PINE GROVE FINANCIAL CALCULATORS FULL#

Would you rather have this money repaid to you right away in one payment or spread out over a year in four installment payments? How would you feel if you had to wait to get the full payment instead of getting it all at once? Wouldn't you feel that the delay in the payment cost you something?Īccording to a concept that economists call the "time value of money," you will probably want all the money right away because it can immediately be deployed for many different uses: spent on the lavish dream vacation, invested to earn interest, or used to pay off all or part of a loan. Periodic Payment (PMT) can be included but is not a required element. In basic finance courses, lots of time is spent on the computation of the time value of money, which can involve 4 or 5 different elements, including Present Value (PV), Future Value (FV), Interest Rate (I/Y), and Number of Periods (N). Related Loan Calculator | Interest Calculator | Investment Calculator

0 kommentar(er)

0 kommentar(er)